stock market and forex market

«`html

Stock Market vs. Forex Market

Introduction

The stock market and forex market are two of the largest and most active financial markets in the world. They both offer investors opportunities to make money, but they have different characteristics and risks. In this article, we will compare the stock market and forex market, and discuss the pros and cons of each.

Stock Market

The stock market is a market where stocks are bought and sold. Stocks represent ownership in a company, and when you buy a stock, you are essentially buying a small piece of that company. The stock market is regulated by the Securities and Exchange Commission (SEC), and it is considered to be a relatively safe investment.

Pros of the Stock Market

Potential for high returns: The stock market has historically provided investors with high returns over the long term.

Diversification: Stocks can be diversified across different industries and sectors, which can help to reduce risk.

Liquidity: Stocks are highly liquid, meaning that they can be easily bought and sold.

Regulation: The stock market is regulated by the SEC, which provides investors with a level of protection.

Cons of the Stock Market

Risk: The stock market is not without risk, and investors can lose money.

Volatility: The stock market can be volatile, meaning that prices can fluctuate widely.

Time commitment: Investing in the stock market requires time and effort.

Forex Market

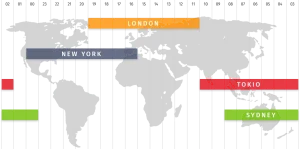

The forex market is a market where currencies are bought and sold. The forex market is the largest financial market in the world, and it is open 24 hours a day, 5 days a week. The forex market is not regulated, which means that it can be more risky than the stock market.

Pros of the Forex Market

Potential for high returns: The forex market can provide investors with high returns, especially if they use leverage.

24/5 trading: The forex market is open 24 hours a day, 5 days a week, which gives investors more flexibility.

Low transaction costs: The transaction costs in the forex market are typically lower than those in the stock market.

No central exchange: The forex market is decentralized, which means that it is not subject to the same regulations as the stock market.

Cons of the Forex Market

Risk: The forex market is not regulated, which means that it can be more risky than the stock market.

Leverage: Leverage can amplify both profits and losses, which can lead to large losses.

Complexity: The forex market can be complex, and it is important to understand the risks before investing.

Which Market Is Right for You?

The stock market and forex market are both complex markets with their own risks and rewards. The best market for you will depend on your individual circumstances and investment goals. If you are looking for a relatively safe investment with the potential for high returns, the stock market may be a good option. If you are looking for a more volatile investment with the potential for higher returns, the forex market may be a better choice.

Here are some additional factors to consider when choosing between the stock market and forex market:

Your risk tolerance: How much risk are you willing to take?

Your investment goals: What are you hoping to achieve with your investment?

Your time commitment: How much time do you have to devote to investing?

Your knowledge and experience: Do you have any experience with investing?

Once you have considered these factors, you can make an informed decision about which market is right for you.

Conclusion

The stock market and forex market are both viable options for investors who are looking to make money. However, it is important to understand the risks and rewards of each market before investing. By carefully considering your individual circumstances and investment goals, you can choose the market that is right for you.

«`