learn all about forex trading

«`html

Learn All About Forex Trading

What is Forex Trading?

Forex trading, also known as foreign exchange trading, is the process of buying and selling currencies to make a profit. Forex is the largest financial market in the world, with trillions of dollars traded each day.

How Does Forex Trading Work?

Forex trading is conducted through a number of different platforms, including online brokerages and banks. When you trade forex, you are buying and selling one currency against another. For example, you might buy the euro against the U.S. dollar, or you might sell the British pound against the Japanese yen.

The value of each currency is determined by supply and demand. When the demand for a currency increases, its value will rise. When the demand for a currency decreases, its value will fall.

What are the Benefits of Forex Trading?

There are a number of benefits to forex trading, including:

High liquidity: Forex is the most liquid financial market in the world, which means that it is easy to buy and sell currencies at any time.

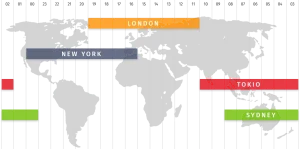

24/5 trading: The forex market is open 24 hours a day, 5 days a week, which gives you the flexibility to trade whenever you want.

Leverage: Forex brokers offer leverage, which allows you to trade with more money than you have in your account. This can increase your potential profits, but it also increases your risk of loss.

What are the Risks of Forex Trading?

There are also a number of risks associated with forex trading, including:

Volatility: The forex market can be very volatile, which means that the value of currencies can fluctuate rapidly. This can lead to losses if you are not careful.

Leverage: Leverage can increase your potential profits, but it also increases your risk of loss. If the market moves against you, you could lose more money than you have in your account.

Counterparty risk: When you trade forex, you are essentially entering into a contract with another party. If the other party defaults on the contract, you could lose your money.

How to Get Started with Forex Trading

If you are interested in getting started with forex trading, there are a few things you need to do:

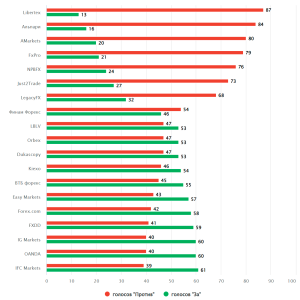

1. Choose a forex broker: The first step is to choose a forex broker. There are many different brokers to choose from, so it is important to compare their fees, trading platforms, and customer service before making a decision.

2. Open a trading account: Once you have chosen a broker, you need to open a trading account. This will require you to provide some personal information and financial details.

3. Fund your account: Once you have opened a trading account, you need to fund it with money. You can do this by bank transfer, credit card, or debit card.

4. Start trading: Once you have funded your account, you can start trading forex. It is important to remember that forex trading is a risky business, so it is important to start out slowly and learn as much as you can about the market before you start trading with real money.

Conclusion

Forex trading can be a lucrative way to make money, but it is important to understand the risks involved before you start trading. By following the steps outlined in this article, you can increase your chances of success in the forex market.

«`